Home loans, car credits and individual advances are instances of portion advances. Portion advances include a set timetable for reimbursing the credit. What’s more, regularly scheduled installments are determined with the goal that you reimburse the credit on plan.

While portion credits are normal, not all have great terms. Great credit can make it simpler for borrowers to meet all requirements for an advance and potentially show signs of improvement financing cost. Be that as it may, when you have lower FICO ratings, you may wind up with a portion credit with a higher loan fee and costly charges.

At whatever point you’re looking for any sort of credit, it’s essential to comprehend the terms you’re consenting to — and furthermore to know where your credit stands. Right now maintain the attention on close to home loan advances. Here are a few things to know about as you’re searching for this sort of portion credit.

What are portion advances for awful credit?

Portion advances for bad credit are close to home advances explicitly intended for individuals with lower FICO assessments, or defective or no financial record.

Some online moneylenders showcase portion advances for borrowers with low financial assessments. Some nearby banks and credit associations may likewise think about applications for individual advances for bad credit.

Individual advances for credit-tested borrowers might be verified (which means borrowers must set up guarantee so as to get an advance) or unbound (no security required). Be that as it may, higher financing costs are a typical quality of both verified and unbound portion advances for borrowers with bad credit.

Read More: Guaranteed Installment Loans For Bad Credit

Normal highlights of terrible credit portion advances

bad credit portion advances work simply like any portion advance.

Credit sums go from two or three hundred to a few thousand dollars.

Reimbursement plans are set up as a progression of installments over a fixed course of events, extending anyplace from a couple of months to quite a while.

Fixed or variable financing costs could apply. Fixed rates implies financing costs that can remain the equivalent for the life of the credit. Variable loan costs are attached to a money related record, so your financing cost (and hence installments) could vary after some time.

Financing costs and terms can change from bank to moneylender, yet awful credit portion advances commonly have…

Higher loan fees. Loan specialists frequently accuse borrowers of lower credit higher financing costs than they provide for borrowers with solid credit. For instance, a bank may tailor explicit advance terms relying upon a borrower’s financial record and different variables.

Higher (or more) expenses. While any close to home advance could accompany expenses, bad credit portion advances frequently have higher charges. For instance, a bank having some expertise in bad credit advances may charge a managerial expense while a moneylender offering advances to borrowers with better credit may charge no regulatory charge by any stretch of the imagination.

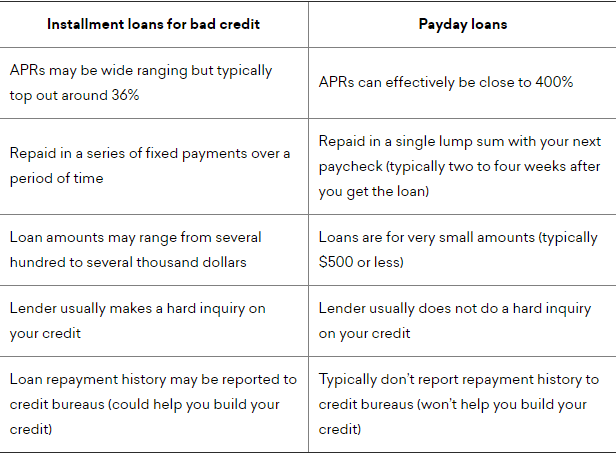

Portion advances for awful credit versus payday credits

While portion advances for bad credit personal loan may have higher rates and less-borrower-accommodating terms, these advances are not equivalent to payday advances. Here’s the means by which portion advances for terrible credit and momentary payday advances vary.

Be careful: Some banks of transient advances may obscure the lines between a portion advance and a payday credit. For instance, you may see “portion advances” publicized for modest quantities with reimbursement terms extending from one to 12 portions and APRs as high as 749%. What’s more, both online portion advance moneylenders and payday banks may guarantee conveyance of assets on the following industry day.

So when looking for an advance, don’t simply concentrate on how the moneylender names it — take a gander at the APR and reimbursement terms to recognize what sort of advance you’re getting and if it’s appropriate for you.

Qualification for portion advances for terrible credit

Qualification prerequisites for portion advances for terrible credit differ by bank. You’ll generally need to give in any event the accompanying:

Your complete name

Your age and verification of personality

Your Social Security number

Insights regarding your salary

Banks may let you see whether you’re probably going to qualify and check your evaluated rates without a hard credit request. When looking for advances, search for loan specialists that furnish this information with just a delicate acknowledge request, as such a large number of requests could hurt your FICO ratings.

Options in contrast to portion advances for terrible credit

While portion advances for terrible credit will quite often have preferred terms over payday advances, loan costs can in any case be entirely high.

Before applying for another advance, you should investigate a few options in contrast to getting — like looking for acknowledge guiding, haggling with your present lenders for more opportunity to reimburse what you owe, or looking for a lower-premium charge card.

Payday elective advances, which are little worth advances gave by some government credit associations, can likewise be a progressively moderate other option — however you’ll should be an individual from the acknowledge association you’re applying for. You’ll despite everything need to take a gander at the particulars of these credits.

Since rates can be high on numerous terrible credit portion advances, looking to locate the correct moneylender is particularly significant on the off chance that you need a portion advance, or any sort of credit, and you have not exactly consummate financial assessments.

Primary concern

Today, borrowers with bad credit have numerous alternatives for portion advances on account of online loan specialists. In any case, before you choose to apply for an advance with the high financing costs that normally oblige these advances, ensure you investigate every single potential choice to make sense of which will work for you.

Furthermore, be mindful so as not to succumb to showcasing that attempts to camouflage a high-intrigue, momentary payday credit as a portion advance. Continuously check credit terms and search for financing with ideal loan costs and a reimbursement plan that works for you.